Take advantage of Section 179 Deductions. Contact Empower Energy Technology today to learn how we can help you save money AND improve your energy efficiency as well as GO GREEN.

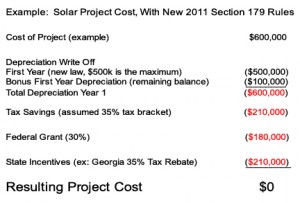

Two congressional acts passed late in 2010 (The Tax Relief Act of 2010 and The Jobs Act of 2010) affected Section 179 in a positive way. The newest changes are as follows:

The Section 179 Deduction limit was increased to $500,000. The total amount of equipment that can be purchased was increased to $2 million. This includes most new and used capital equipment, and also includes software.

The “Bonus Depreciation” was increased to 100% on qualified assets. However, this can be taken on new equipment only.

When applying these provisions, Section 179 is generally taken first, followed by Bonus Depreciation – unless the business has no taxable profit in 2011.

Also, many businesses find Section 179 Qualified Financing to be an attractive option in 2011.

Section 179 can be extremely profitable to you, so it is to your benefit to learn as much as possible. To begin, you probably have a lot of questions regarding Section 179. Questions like:

- What is Section 179?

- What equipment qualifies for the Section 179 Deduction?

- Any difference between Section 179 & Bonus Depreciation?

- Can I lease equipment and still qualify for Section 179?

- Does software qualify for Section 179?

- What impact did all the Stimulus Acts have on Section 179?

- How do I elect to take the Section 179 Deduction?

To learn the answers to these questions about Section 179 Deductions, visit this website: http://section179.org/. Then contact Mark Bell (mbell@empoweret.com) at Empower Energy Technology (404.681.3270) to learn how we can assist you with energy and green equipment purchases and installation that are covered under Section 179 Deductions.

JUN

About the Author: